Calculate ltv heloc

Loan-to-value ratio LTV is the percentage of your homes appraised value that is borrowed - including all outstanding mortgages and home equity loans and lines secured by your home. A HELOC on the other hand gives you the flexibility to borrow and pay off the credit whenever you want.

Heloc Calculator

Learn how a HELOC payment is calculated.

. Heloc Combo Rates 5240 95 LTV Apply Now. Available equity in the home. View More Homeowner Resources.

A Smart Refinance loan is a no-closing-cost mortgage refinance option that lets you take advantage of lower rates get cash out. You can calculate this figure by taking the current market value of. The HELOC repayment is structured in two phases.

A home equity line of credit HELOC allows homeowners to borrow funds based on the equity they own in the home. Additionally you may be limited to borrowing 85 of your homes value minus your outstanding loan balance though some lenders offer high-LTV home equity loans. August 31 202210-Year HELOC Rates Reach A 52.

HELOC Home Equity Loan Qualification. The HELOC calculator is calculated based on your current HELOC balance interest rate interest-only period and the repayment period. The draw period is the phase.

For example if the LTV ratio is 75 or lower you could get a lower rate because the loan is seen as less risky to the lender. PNC only offers a HELOC for home equity with interest rates from 225 to 24 and no minimum draw amount. Above you could get a home equity line of credit.

The loan-to-value ratio LTV ratio is a lending risk assessment ratio that financial institutions and others lenders examine before approving a mortgage. HELOC versus Home Equity Loan. To get a home equity loan or HELOC with bad credit will require a debt-to-income ratio in the lower 40s or less a credit score of 620 or more and a home worth at least 10 to 20 more than what.

Here Are Todays HELOC Rates. HELOC Payment Calculator excel to calculate the monthly payments for your HELOC loan. While both a HELOC and a second mortgage use your home equity as collateral a second mortgage can offer you access to a higher total borrowing limit at a higher interest.

Learn More about Managing Your HELOC. Your home value Your home value. For screen reader users pausing the slider will allow the slides to be announced simply when you.

Loan-To-Value Ratio - LTV Ratio. A first lien HELOC is a line of credit and mortgage in one. They often work by replacing your existing mortgage taking over as a first mortgage while also working like a checking account.

It also helps your lender determine whether or not youll have to pay for private mortgage insurance PMI. Fields Terms and Definitions. 799 APR Calculate.

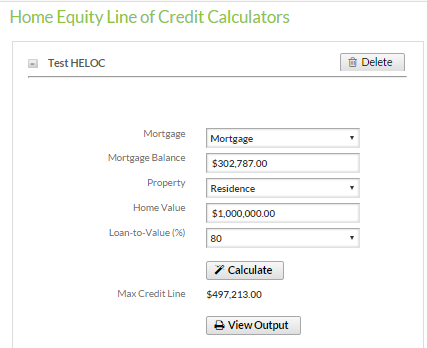

Your HELOC limit can be determined using the loan to value LTV ratio and remaining mortgage balance. Home equity line of credit calculator excel will calculate the payments and show you an amortization schedule for each payment. Rates quoted require a loan origination fee of 100 which.

Or LTV and credit score before making a decision on your HELOC application. It can play a big role in the interest rate that you get since the appraisal helps determine your LTV loan-to-value ratio. Your home appraisal can also affect your home loan during a refinance.

To calculate your homes equity divide your current mortgage balance by your homes market value. Get answers to questions about your HELOC including how we calculate your interest rate. The line of credit is based on a percentage of the value of your home which is also known as loan-to-value LTV.

A Home Equity Loan is more like a traditional. People with an excellent credit score of above 760 will get the best rates. Loan-to-value LTV occupancy and loan purpose so your rate and terms may differ.

Results are estimated based on a Smart Refinance loan amount of. Use our HELOC calculator to find out how much you could borrow with a home equity line of credit. You may apply for a Smart Refinance loan up to.

This section of the page contains a carousel that visually displays various slides one at a time. And the loan to value LTV the lender is willing to extend to you. September 6 202210-Year HELOC Rates Hit A New High By Andrea Riquier Forbes Advisor Staff Average HELOC Rates.

All with the Lower Home Equity Line of Credit. A home equity line of credit HELOC on the other hand is another type of second mortgage that uses your home as collateral. You can compute LTV for first and second mortgages.

For example if your current balance is 100000 and your homes market value is 400000. The more your home is. Home equity loans vs.

Up to 95 LTV with a HELOC Combo Calculate your available funds. All loans subject to credit approval. Calculate the equity available in your home using this loan-to-value ratio calculator.

Your credit line caps at 899 of your homes equity depending on the state where you live and you can draw on your account for 10 years paying interest-only payments then add principal to repay the loan in full over the next 20 years. Lender APR Introductory APR Line Amount Range HELOC Terms Max LTV. If you own at least 20 of your home an LTV of 80 or less youll probably qualify for a home equity loan depending on.

Find out how to calculate the equity in your home your home equity percentage and the loan-to-value LTV based on the current market price. For example a lenders 80 LTV limit for a home appraised at 400000 would mean a HELOC applicant could have no more than 320000 in total outstanding home. 15000 to 750000 up to 1 million for properties in California.

What is the difference between getting a HELOC and a second mortgage. As mentioned above banks typically allow a max LTV of 70 to 85. Make more home renovations.

Pay off more high-interest debt. Just to be clear a Home Equity Line of Credit is not the same thing as a Home Equity Loan. You receive the funds on.

Those with good credit. Use this calculator to determine the home equity line of credit amount you may qualify to receive. Click the Calculate HELOC Payment button.

To avoid PMI your LTV typically needs to be 80 or less but PMI applies only to first liens so if your home equity line of credit is a second lien against your house you shouldnt have to worry about paying PMI. The tool will immediately calculate your current loan-to-value ratio. The three primary things banks look at when assessing qualification for a home equity loan are.

399 APR Calculate. HELOC Payments How are HELOC repayments structured.

Heloc Loan Calculator Outlet 50 Off 360ski Bike Cl

Heloc Loan Calculator Outlet 50 Off 360ski Bike Cl

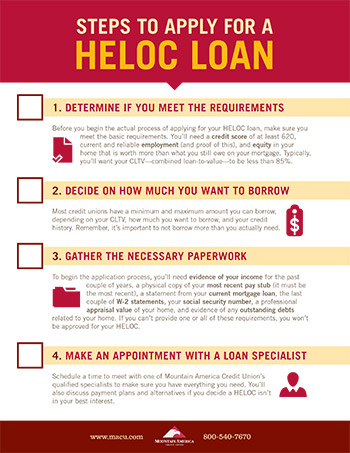

Home Equity Line Of Credit Heloc Macu

Home Equity Line Of Credit Heloc Rocket Mortgage

Heloc Loan Calculator Outlet 50 Off 360ski Bike Cl

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Macu

Home Equity Line Of Credit Calculator Union Bank Of Mena

Heloc Calculator How Much Could You Borrow Nerdwallet

How To Calculate Equity In Your Home Nextadvisor With Time

Home Equity Line Of Credit Heloc Rocket Mortgage

How A Heloc Works Tap Your Home Equity For Cash

Heloc Loan Calculator Outlet 50 Off 360ski Bike Cl

Home Equity Line Of Credit Qualification Calculator

Home Equity Line Of Credit Qualification Calculator

Heloc Calculator Calculate Available Home Equity Wowa Ca

Home Equity Line Of Credit Heloc Rocket Mortgage

Komentar

Posting Komentar